maine tax rates compared to other states

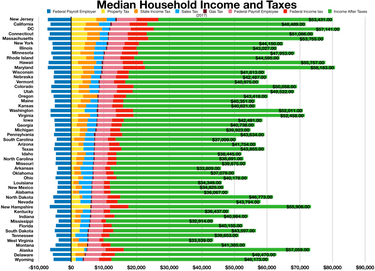

20 for sales and excise taxes. California tops the list with the highest income tax rates in the countryits highest tax rate is 123 but it also implements an additional tax on those.

State Budget Gives Another Round Of Tax Cuts To The Wealthiest Who Already Pay Lowest Rates Beacon

Use this tool to compare the state income taxes in Maine and Massachusetts or any other pair of states.

. Your average tax rate is 1198 and your marginal tax rate is 22. The Town of Scarboroughs new tax rate is now set at 1502 per 1000 of property value for the 2022 fiscal year which runs from July. Maine has a graduated individual income tax with rates ranging from 580 percent to 715.

Taxes in Maine Maine Tax Rates Collections and Burdens. Based on this chart New Hampshire taxpayers pay 97 of their total income to state and local taxes. Compare these to California where.

If you make 70000 a year living in the region of Maine USA you will be taxed 12188. Other New England states ranked higher than Massachusetts as well including Vermont at 1075. Maine Tax Rates Compared To Other States.

Compared with other states Maine has relatively punitive tax rules for. In the overall rankings other New England states ranked as follows. One tax collection area where New Hampshire outpaces.

Texas residents also dont pay income tax but spend 18 of their income on real estate taxes one of the highest rates in the country. Those are all good reasons to choose Maine as a retirement destination but what about the states tax system. The state ranked No.

The map below will help you with your research. 21 in a comparison of individual income taxes and No. No state sales tax.

Maine Tax Rates Compared To Other States. Up to 25 cash back 14. How does Maines tax code compare.

Vehicle Property Tax Rank Effective Income Tax Rate. Maine Income Tax Calculator 2021. This tool compares the tax brackets for single individuals in each state.

Click on any state for a detailed summary of its taxes on income property and items you buy on a daily basis. Connecticut at 1044 and Rhode Island at 969. Massachusetts taxpayers pay 105.

Tax Debates In U S Maine Focus On What Rich Should Pay

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Which States Have The Highest Taxes On Marijuana Priceonomics

State Tax Levels In The United States Wikipedia

Maine Who Pays 6th Edition Itep

Maine Loses People And Their Income To States With No Personal Income Tax Maine Policy Institute

Raising State Income Tax Rates At The Top A Sensible Way To Fund Key Investments Center On Budget And Policy Priorities

What Maine Town Has The Lowest Mill Rate Maine Homes By Down East

Colorado Sales Tax Rate Rates Calculator Avalara

Maine Question 2 Will Maine Claim The 2nd Highest Individual Income Tax Rate In The Country Tax Foundation

The Tax Rate On A 2 Million Home In Each U S State Mansion Global

Maine Sales Tax Calculator And Local Rates 2021 Wise

Sales Taxes In The United States Wikipedia

State Income Tax Revenue Falls As Bill For 2011 Income Tax Cuts Comes Due Mecep

Maine Income Tax Brackets 2020

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates